The battle is on with AI chips

With their Zen-based Ryzen CPUs, AMD made a strong comeback in personal computers and traditional server chips, where they have fought for years with industry giant Intel in one of the tech world's most intense rivalries. Now the explosive growth of AI has set the stage for AMD vs. Nvidia, another tech decision, this time pitting the dominant force in AI chips against a challenger with a history of turning a second-place role into a position of strength.

The rivalry will take center stage at Nvidia's big AI event on March 18 in San Jose, California. The company is expected to unveil its next-generation product, the B100, its first Blackwell series GPU, on Monday at Nvidia's GTC 2024 conference for AI developers. Nvidia holds its AI event, while AMD ramps up production of its MI300 AI chip.

AMD's strength as a tough and resilient competitor is underscored by its long-standing rivalry with Intel. AMD was on the brink of collapse, with the stock price at less than $2, when CEO Lisa Su took over over a decade ago.

But AMD fought back to regain market share in PCs and servers, although it has never come close to overtaking Intel. Intel had 72.4% of total PC chip shipments in the fourth quarter of 2023, followed by AMD with 18.3% and Apple with 7.8%, according to IDC. Intel is also dominant in server chips with 68.7% unit market share in Q3 2023, surpassing AMD's 20.5% share.

But AMD has gained strength from an important fact: Manufacturers prefer not to be locked into one supplier. Having more than one choice is always preferred.

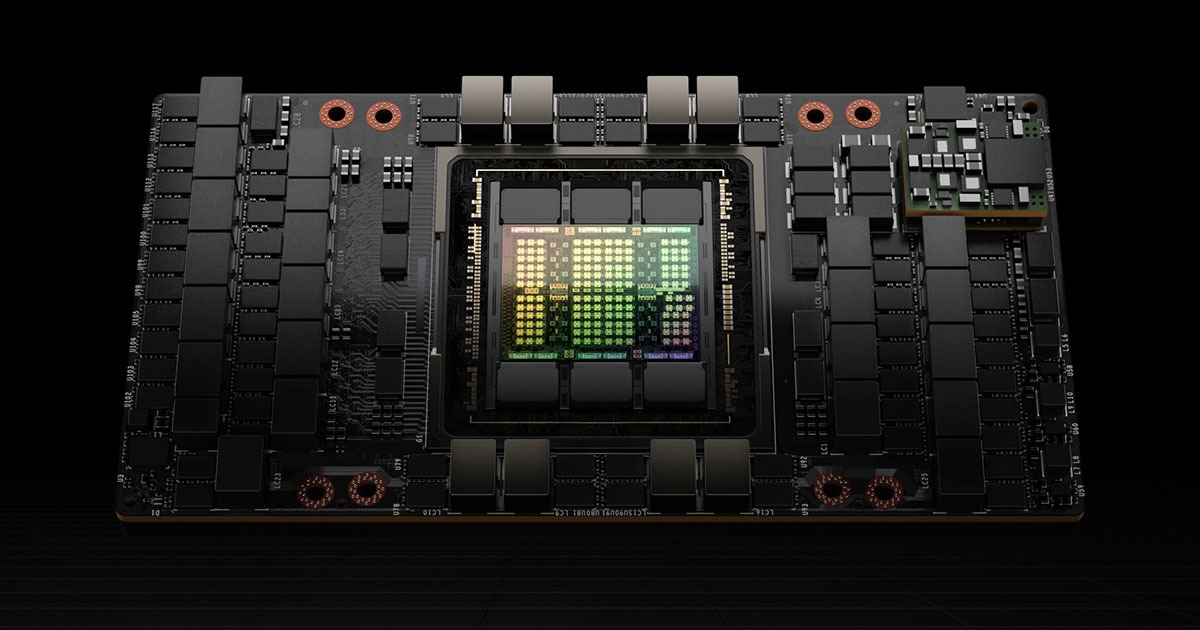

Nvidia currently dominates the market for graphics processing units, or GPUs, used to run compute-heavy AI workloads. But AMD has proven to be a capable fast follower.

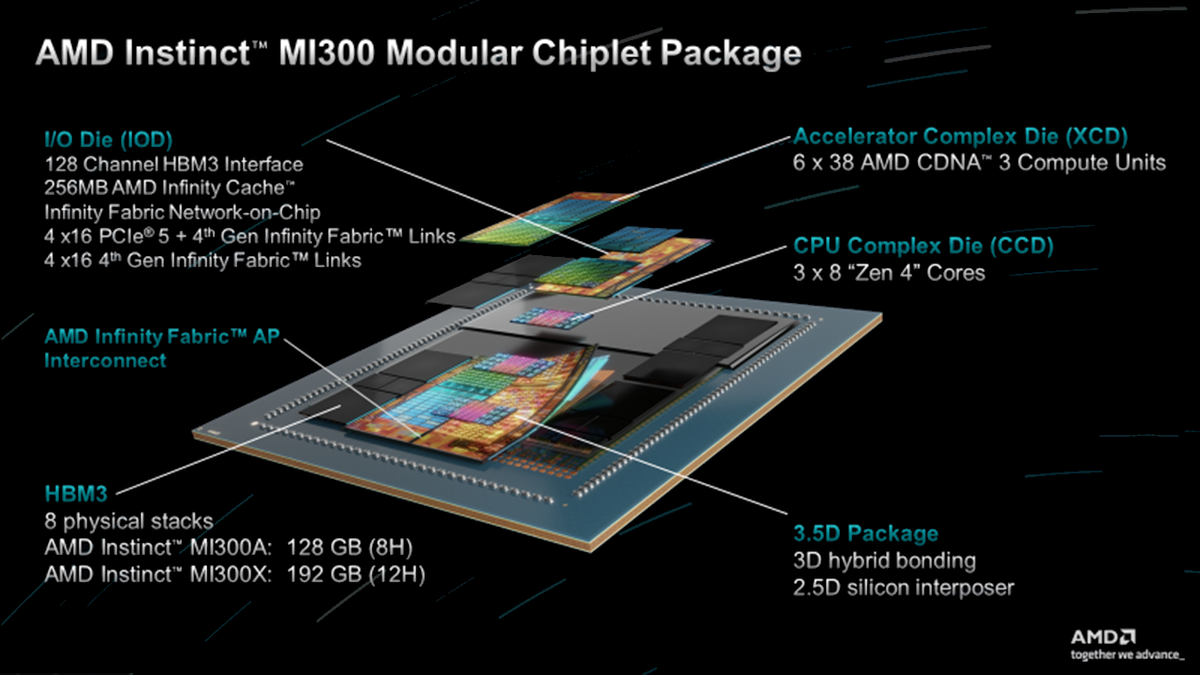

AMD's Instinct MI300 series accelerators provide a viable alternative to Nvidia's current H100 GPU, analysts say.

AI chip customers, such as cloud service providers and enterprises, value having a strong second-to-market to keep prices down and drive innovation.

And AMD is optimistic about where the market is headed.

On a Jan. 30 conference call with analysts, Su, the chip company's CEO, said the accelerator market could grow to about $400 billion by 2027. That figure surprised Wall Street because it was far above their forecasts.

"The beauty of the AI market is that it's growing so fast that I think we have both the market dynamics and the ability to gain market share in that framework," Su said.

During the Morgan Stanley Technology, Media & Telecom Conference on March 5, AMD CFO Jean Hu defended the forecast.

"We can debate whether it's 400 billion or 300 billion, but the direction of this technology trend is really extraordinary," Hu said. She noted that the market was $40 billion last year and is likely to reach about $100 billion this year.

"It's a big market," she said. "We are a strong number two in this market."

AMD didn't really have a product to compete with Nvidia in the AI market until it launched its MI300 data center GPU accelerator family on December 6th. Now they are focusing on gaining market share in AI.

Since AMD increased its presence in the AI accelerator market last year, Nvidia has moved to come up with a new flagship product every year to match AMD's annual cadence. Nvidia was previously on a two-year cycle for its product launches in the category.

Nvidia is widely expected to detail the capabilities of its next-generation product, the B100, on Monday at GTC. The B100 will be available later this year. And in 2025, Nvidia plans to overtake that chip with its X100 GPU.

Right now Nvidia is selling every H100 GPU they can make and has the order books full. But their inability to meet the demand for AI chips created an opening for AMD and others to gain market share. Other players on the market include Intel with its Gaudi AI processors.

Latest processor - cpu

-

26 Aprprocessor - cpu

-

26 Aprprocessor - cpu

TSMC's new COUPE tech ready in 2026

-

26 Aprprocessor - cpu

First NVIDIA DGX H200 for OpenAI

-

25 Aprprocessor - cpu

Qualcomm unveils Snapdragon X Elite

-

25 Aprprocessor - cpu

TSMC's 'A16' chip poised to challenge Intel in 202

-

25 Aprprocessor - cpu

Nvidia is still strong on AI but can be challenged

-

23 Aprprocessor - cpu

China acquires banned Nvidia chips

-

19 Aprprocessor - cpu

SK hynix and TSMC collaborate on new chips

Most read processor - cpu

Latest processor - cpu

-

26 Aprprocessor - cpu

Nye AMD Strix Point, Strix Halo spec leaks

-

26 Aprprocessor - cpu

TSMC's new COUPE tech ready in 2026

-

26 Aprprocessor - cpu

First NVIDIA DGX H200 for OpenAI

-

25 Aprprocessor - cpu

Qualcomm unveils Snapdragon X Elite

-

25 Aprprocessor - cpu

TSMC's 'A16' chip poised to challenge Intel in 202

-

25 Aprprocessor - cpu

Nvidia is still strong on AI but can be challenged

-

23 Aprprocessor - cpu

China acquires banned Nvidia chips

-

19 Aprprocessor - cpu

SK hynix and TSMC collaborate on new chips