Nvidia operates global stock code

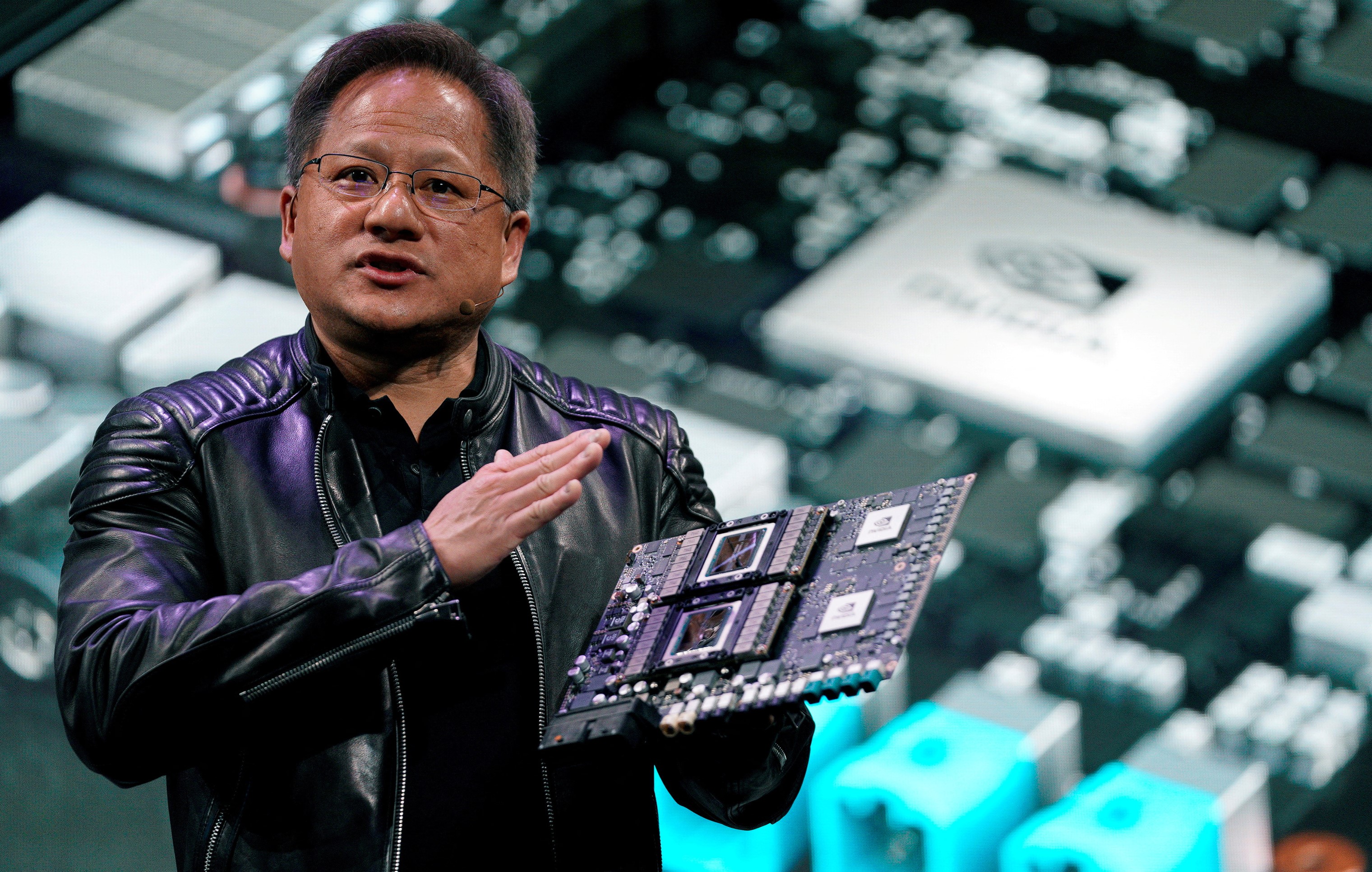

AI chipmaker Nvidia's impressive results on Thursday sparked a global wave of record share prices, including the first new peak for Japan's Nikkei since 1989. Bond yields rose mostly as economic data kept immediate hopes of interest rate cuts at bay. The S&P 500 index and the Dow Jones Industrial Average on Wall Street, along with Europe's pan-regional STOXX 600 index and MSCI's all-country world index, also hit record highs as Nvidia shares rose 16.4 percent and lifted shares in artificial intelligence-related chip companies around the world.

National bourses in Frankfurt and Paris also set new records, while overnight Chinese shares extended their winning streak to eight in a row. After trading ended Wednesday, Nvidia predicted a roughly three-fold increase in first-quarter revenue and beat expectations for fourth-quarter revenue due to strong demand for its AI chips.

Nvidia added $277 billion in market capitalization, the largest one-day increase in a company's market capitalization in history. "What Nvidia represents is the catalyst for the Roaring 20s in terms of productivity improvement going forward, and when productivity increases, it keeps inflation in check," said Thomas Hayes, chairman and managing member of Great Hill Capital LLC in New York.

Latest hardware

-

13 Octcomputer mouse

-

10 Octprinter

New arrivals from Bambu Lab

-

02 Octprinter

Bambu Lab opens Flagship Store in China

-

26 Sepmotherboard

MSI MPG Z890 CARBON WIFI

-

25 Junprinter

Elegoo launches reinforced filament

-

20 Junprinter

Bambu Lab Store turns three years old

-

26 Mayhardware

BeQuiet news from Computex 2025

-

25 Marprinter

Bambu Lab launches H2D

Most read hardware

Latest hardware

-

13 Octcomputer mouse

Logitech MX Master 4

-

10 Octprinter

New arrivals from Bambu Lab

-

02 Octprinter

Bambu Lab opens Flagship Store in China

-

26 Sepmotherboard

MSI MPG Z890 CARBON WIFI

-

25 Junprinter

Elegoo launches reinforced filament

-

20 Junprinter

Bambu Lab Store turns three years old

-

26 Mayhardware

BeQuiet news from Computex 2025

-

25 Marprinter

Bambu Lab launches H2D