Chinese companies manufacture HBM memory

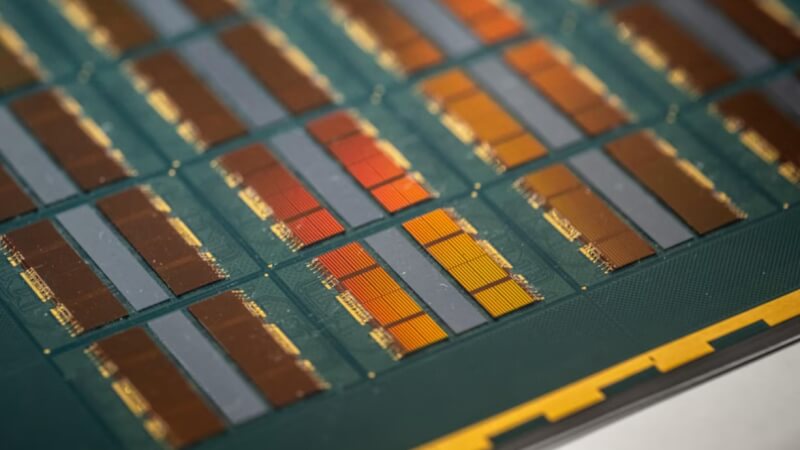

HBM, a type of DRAM standard first produced in 2013 where chips are vertically stacked to save space and reduce power consumption, is ideal for processing massive amounts of data generated by complex AI applications.

Demand has increased significantly in line with the AI boom. The market for HBM is dominated by South Korea's SK Hynix, until recently the sole HBM supplier to AI chip giant Nvidia according to analysts, as well as Samsung and, to a lesser extent, US firm Micron Technology.

All three manufacture the latest standard, HBM3 chips, and are working to bring fifth-generation HBM, or HMB3E, to customers this year. The HBM technology is revolutionary for AI applications. By vertically stacking DRAM chips, HBM can deliver increased data speed and bandwidth, which is essential for AI's intensive data processing.

Two Chinese chipmakers are in the early stages of producing memory-intensive semiconductors (HBM) used in artificial intelligence chipsets, according to sources and documents.

The progress in HBM, although only in older versions of HBM, represents a major step forward in China's efforts to reduce its reliance on foreign suppliers in the face of tensions with Washington that have led to restrictions on US exports of advanced chipsets to Chinese companies.

CXMT, China's largest maker of DRAM chips, has developed trial HBM chips in collaboration with chip packaging and testing firm Tongfu Microelectronics, according to three people briefed on the matter. Two of them said the chips are being shown to customers.

In another example, Wuhan Xinxin is building a factory that will be able to produce 3,000 12-inch HBM wafers per month, and construction is scheduled to have begun in February this year, documents from company database Qichacha show.

CXMT and other Chinese chip companies have also held regular meetings with South Korean and Japanese semiconductor equipment companies to buy tools to develop HBM, two of the people said.

Wuhan Xinxin, which has notified authorities that it is interested in going public, and its parent company did not respond to requests for comment. The parent company is also the parent company of NAND memory specialist YMTC or Yangtze Memory Technologies. YMTC said they did not have the ability to mass produce HBM.

Both CXMT and Wuhan Xinxin are private companies that have received support from local governments to promote technologies as China invests capital to develop its chip sector.

Separately, Chinese tech giant Huawei — which the U.S. has deemed a national security threat and is subject to sanctions — aims to produce HBM2 chips in collaboration with other domestic companies by 2026, according to one of the sources and another person familiar with the matter. the case.

Latest ram

-

07 Augram

-

06 Augram

Samsung presents thinnest LPDDR5X DRAM

-

05 Augram

SK hynix focuses on advanced HBM chips

-

31 Julram

SK Hynix launches 60% faster GDDR7

-

28 Junram

SK Hynix accelerates HBM plan

-

17 Junram

AI boosts local chip demand in China

-

17 Junram

Samsung to launch 3D HBM chip service in 2024

-

16 Mayram

MSI and Patriot launch Viper Gaming RAM

Most read ram

Latest ram

-

07 Augram

Nvidia approves Samsung's 8-layer HBM3E chips

-

06 Augram

Samsung presents thinnest LPDDR5X DRAM

-

05 Augram

SK hynix focuses on advanced HBM chips

-

31 Julram

SK Hynix launches 60% faster GDDR7

-

28 Junram

SK Hynix accelerates HBM plan

-

17 Junram

AI boosts local chip demand in China

-

17 Junram

Samsung to launch 3D HBM chip service in 2024

-

16 Mayram

MSI and Patriot launch Viper Gaming RAM