SK Hynix surprises with record profits

South Korea's SK Hynix Inc said on Thursday it will focus this year on high-performance memory semiconductors used in artificial intelligence chipsets after strong demand led to a surprise fourth-quarter profit. The world's second-largest memory chip maker, which has AI chip leader Nvidia as a key client, reported operating income of 346 billion won ($259.8 million) for the October-December quarter.

Revenue increased by 47%. It beat expectations for an operating loss of 192 billion won and marked its first operating profit since the third quarter of 2022. The firm had reported a loss of 1.9 trillion won a year earlier.

"We achieved a turning point ... after a long downturn, thanks to our technological leadership in the AI memory space," CFO Kim Woohyun said in a statement, adding that the company will strive to "grow into a total AI memory supplier" .

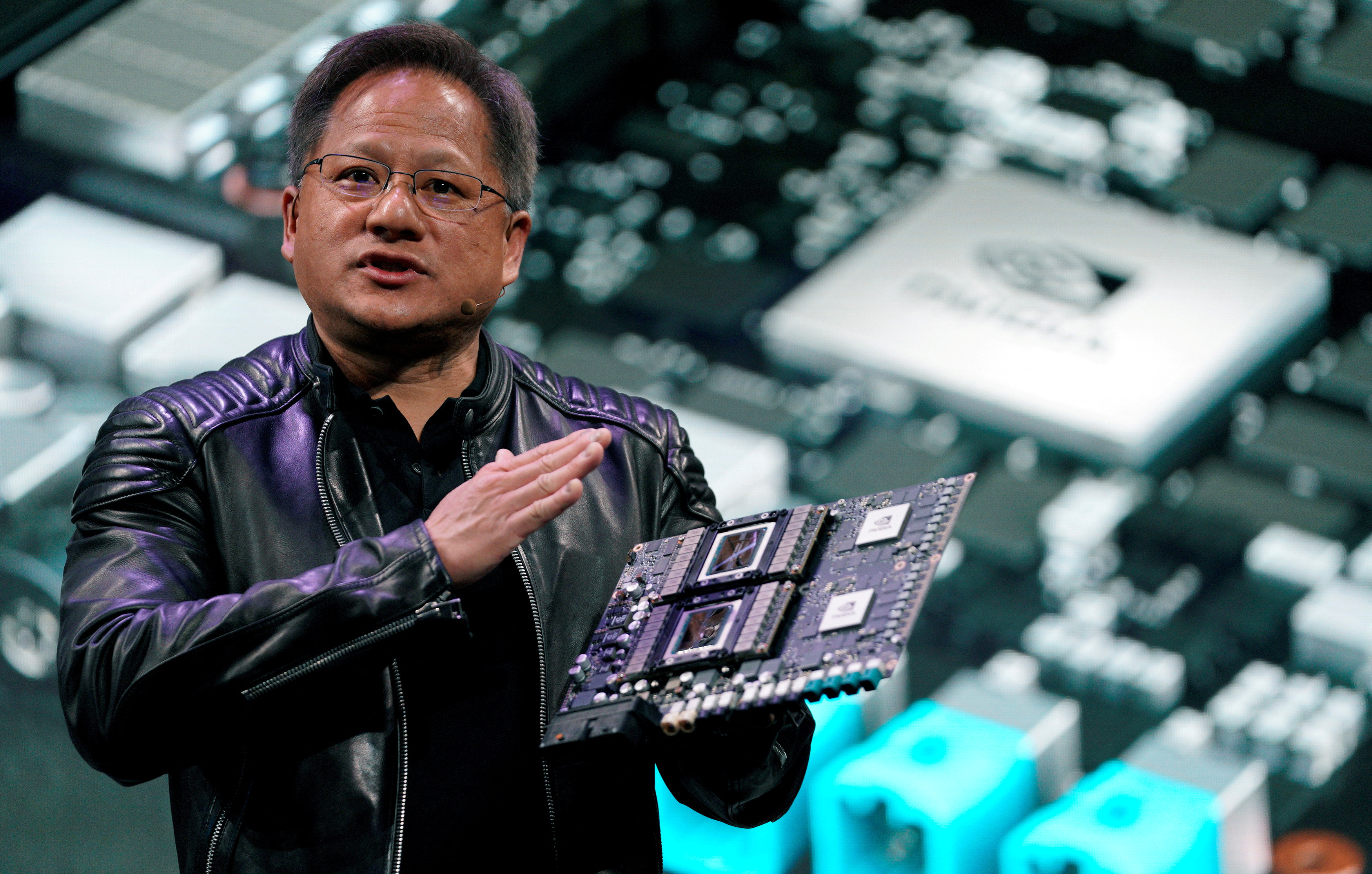

SK Hynix's advanced DRAM chips, such as high-bandwidth memory (HBM) chips, are in high demand for use in the graphics processing units (GPUs) made by Nvidia and others that process large amounts of data in generative AI.

The company said its sales of HBM3 chips, which it developed ahead of its competitors, rose more than fivefold in 2023 from a year earlier. With demand expected to grow from clients such as Nvidia, cloud service providers and other major technology companies as AI capabilities are increasingly incorporated into devices, SK Hynix's leadership in HBM chip development is set to help it improve profitability and outperform the market this year, analysts said.

"For hot (AI) products, demand is so strong that clients are complaining they can't get enough supplies. It's a completely different story for the rest of the memory industry, which is slowly recovering from weak demand," said Greg Roh, head of research at Hyundai Motor Securities. Roh estimated that HBM chips will rise to account for 15% of the industry's total DRAM sales this year, up from 8% in 2023.

SK Hynix plans to begin mass production of its next HBM version, called HBM3E, in the first half of the year. It is also developing the next generation chip called HBM4. The company's shares, which have risen 18% since its last quarterly earnings release on the upbeat outlook for AI memory chips, fell 2.6% in afternoon trade due to profit-taking, analysts said.

Whether the great focus on HBM RAM and a possible change of production resources will have an impact on availability and prices for the more common consumer-oriented RAM products is too early to say yet. You could, however, as an ordinary consumer who wants to build a system for gaming or the like. fear that we can look forward to a price increase for RAM.

Latest ram

-

07 Augram

-

06 Augram

Samsung presents thinnest LPDDR5X DRAM

-

05 Augram

SK hynix focuses on advanced HBM chips

-

31 Julram

SK Hynix launches 60% faster GDDR7

-

28 Junram

SK Hynix accelerates HBM plan

-

17 Junram

AI boosts local chip demand in China

-

17 Junram

Samsung to launch 3D HBM chip service in 2024

-

16 Mayram

MSI and Patriot launch Viper Gaming RAM

Most read ram

Latest ram

-

07 Augram

Nvidia approves Samsung's 8-layer HBM3E chips

-

06 Augram

Samsung presents thinnest LPDDR5X DRAM

-

05 Augram

SK hynix focuses on advanced HBM chips

-

31 Julram

SK Hynix launches 60% faster GDDR7

-

28 Junram

SK Hynix accelerates HBM plan

-

17 Junram

AI boosts local chip demand in China

-

17 Junram

Samsung to launch 3D HBM chip service in 2024

-

16 Mayram

MSI and Patriot launch Viper Gaming RAM