Nvidia earnings may have weakness

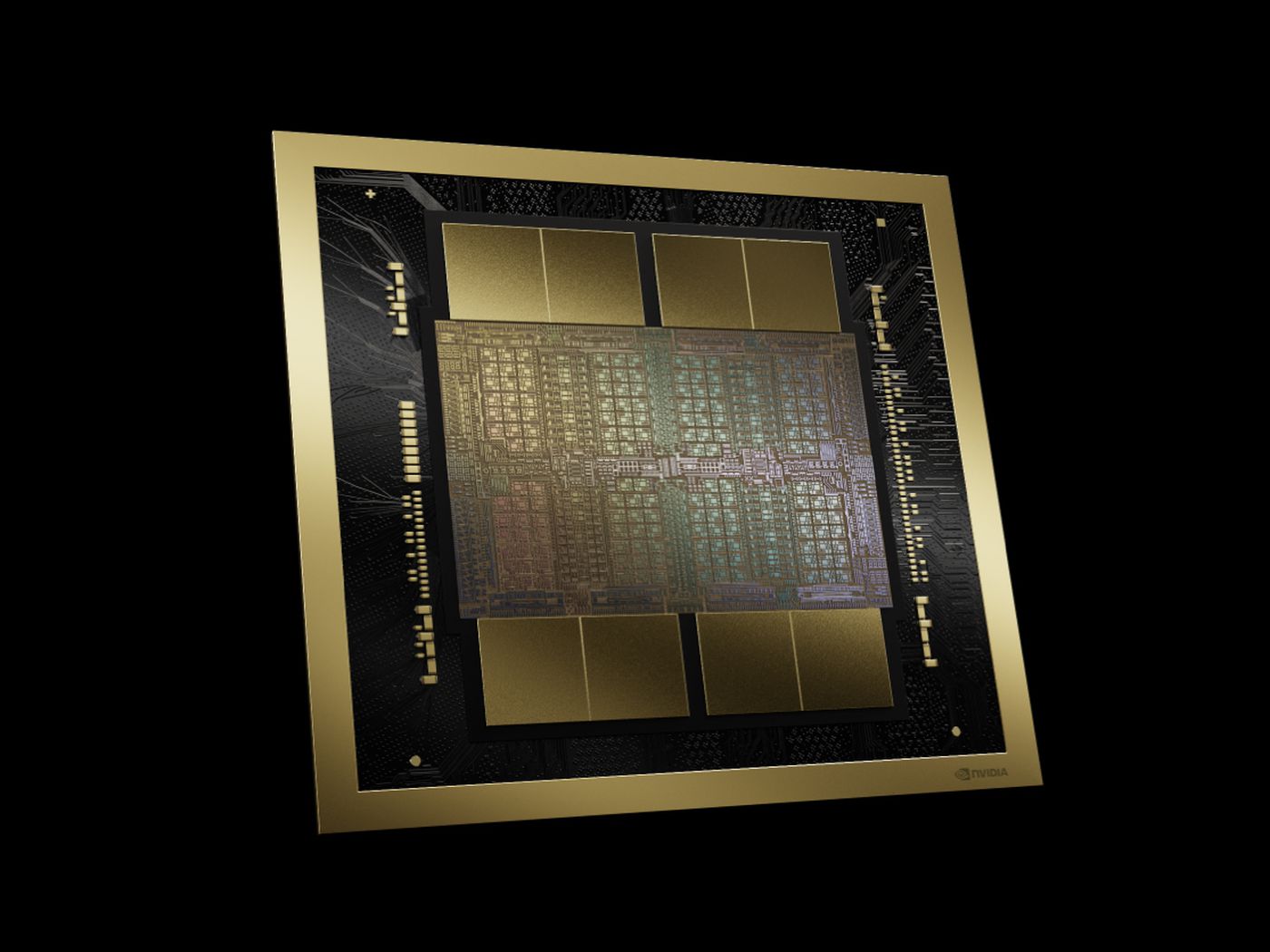

Nvidia has achieved a dominant position with leading products and designs that are the best for modern AI processing. Wednesday will be a pivotal quarterly event for both the technology market and the broader stock market as Nvidia reports its second quarter results.

According to Nvidia's previous earnings call, revenue of $28 billion with a margin of around 75% is expected in the second quarter of 2025. If they reach this revenue target, it will more than double revenue on a year-over-year basis (revenue in the second quarter of 2024 was $13.5 billion) and see another quarterly revenue record.

But it would also mean that quarterly revenue growth has fallen over the last four reports - where revenue has previously increased by $6 billion, $5 billion and $4 billion, respectively. Also taking into account the rumors and speculation about the delays on their most advanced Blackwell AI chip architecture, this could mean that the quarter's result might be disappointing for investors and the tech industry.

Competition is growing

Nvidia continues to grow and make money, thanks to its dominance in the training and inference capabilities of AI chips. This growth continues to attract the attention of competitors eager to take as much of the market as possible for themselves. AMD is the most obvious contender, with a product line most similar to the GPU designs of Nvidia as they compete in both the gaming and professional graphics markets.

Advanced AI infrastructure While competitors are still fighting to enter the AI chip space, Nvidia's biggest customers are invested in historical infrastructure buildings. A report shows that up to 40% of the money Microsoft and Meta spend goes to Nvidia. With Tesla, Google and Amazon in the range from 10%-30%. These companies (and more) continue to invest large sums of money in new hardware, and Nvidia will be the primary beneficiary for a long time.

Nvidia's leadership is hard to challenge Nvidia has earned its leading position with leading products and designs that are the best for modern AI processing. Even rumors of delays on the latest Blackwell AI chip from Nvidia don't seem to give AMD, Intel or anyone else much of a chance.

All indications are that Nvidia's current generation Hopper H100 chips will maintain pure performance leadership for the rest of the year. Nvidia's growth and trajectory will continue through 2024 and 2025, across products, competition and partner investments.

Latest gadgets

-

19 Sepgadgets

-

23 Maygadgets

LaserPecker LP5 Laser Engraver

-

01 Maygadgets

Swytch launches Swytch Max+ Kit

-

10 Margadgets

DJI AIR 3S

-

03 Margadgets

Razer Wolverine V3 Pro

-

21 Febgadgets

OBSBOT Tiny 2 SE

-

13 Febgadgets

Corsair launches Platform:4

-

17 Jangadgets

Nerdytek Cycon3

Most read gadgets

Latest gadgets

-

19 Sepgadgets

DJI launches Mini 5 Pro

-

23 Maygadgets

LaserPecker LP5 Laser Engraver

-

01 Maygadgets

Swytch launches Swytch Max+ Kit

-

10 Margadgets

DJI AIR 3S

-

03 Margadgets

Razer Wolverine V3 Pro

-

21 Febgadgets

OBSBOT Tiny 2 SE

-

13 Febgadgets

Corsair launches Platform:4

-

17 Jangadgets

Nerdytek Cycon3