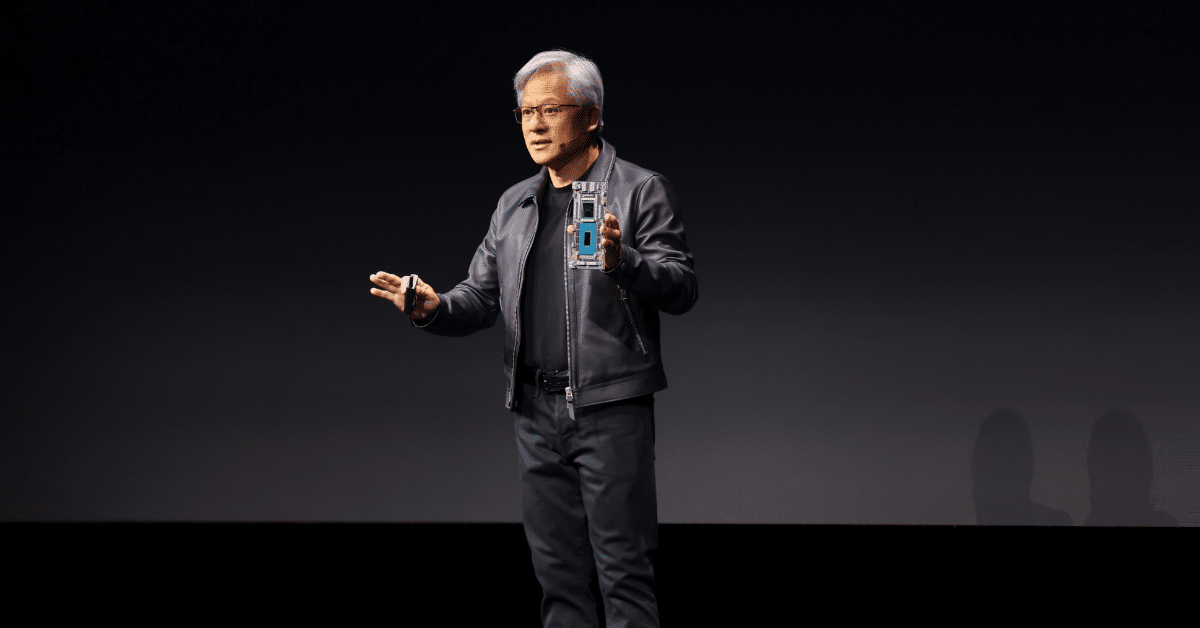

Nvidia growth peaks

At first glance, NVIDIA delivered another quarterly performance that exceeded analysts' expectations for both revenue and earnings. They also presented an impressive forecast for the current quarter, with expected revenue of $32.5 billion, beating consensus expectations by about $600 million.

But there are some significant caveats beneath the surface. First, NVIDIA's net profit margin has fallen for the first time since the second quarter of 2022.

Also, consider that NVIDIA now expects a gross margin of 74.4 percent for the current quarter, which is lower than both the actual margin of 76.7 percent in the ended June quarter and the expected margin of 74.8 percent for the same quarter.

Another possible weakness in NVIDIA's position is that its revenue from data center operations in China has fallen below the level seen before the US imposed export controls.

As for Blackwell, NVIDIA confirmed rumors of a minor design flaw, but noted that the problem was solved by changing the photomask — a specific template used to create patterns on semiconductor wafers.

With these changes, the company expects to begin shipping Blackwell products in the quarter ending December, with a ramp-up of Hopper deliveries in the second half of 2024.

However, the minor delay with Blackwell will come at a cost: NVIDIA noted during the earnings call that they will "experience weaker margins in the fourth quarter."

The period of uninterrupted and unfailing growth for NVIDIA now appears to be over. Although the company is still a strong money maker, the stock market has now factored in a temporary pause in growth -- albeit only by certain metrics -- in NVIDIA's stock price, which has reduced some of the previously staggering high value.

Latest gadgets

-

19 Sepgadgets

-

23 Maygadgets

LaserPecker LP5 Laser Engraver

-

01 Maygadgets

Swytch launches Swytch Max+ Kit

-

10 Margadgets

DJI AIR 3S

-

03 Margadgets

Razer Wolverine V3 Pro

-

21 Febgadgets

OBSBOT Tiny 2 SE

-

13 Febgadgets

Corsair launches Platform:4

-

17 Jangadgets

Nerdytek Cycon3

Most read gadgets

Latest gadgets

-

19 Sepgadgets

DJI launches Mini 5 Pro

-

23 Maygadgets

LaserPecker LP5 Laser Engraver

-

01 Maygadgets

Swytch launches Swytch Max+ Kit

-

10 Margadgets

DJI AIR 3S

-

03 Margadgets

Razer Wolverine V3 Pro

-

21 Febgadgets

OBSBOT Tiny 2 SE

-

13 Febgadgets

Corsair launches Platform:4

-

17 Jangadgets

Nerdytek Cycon3