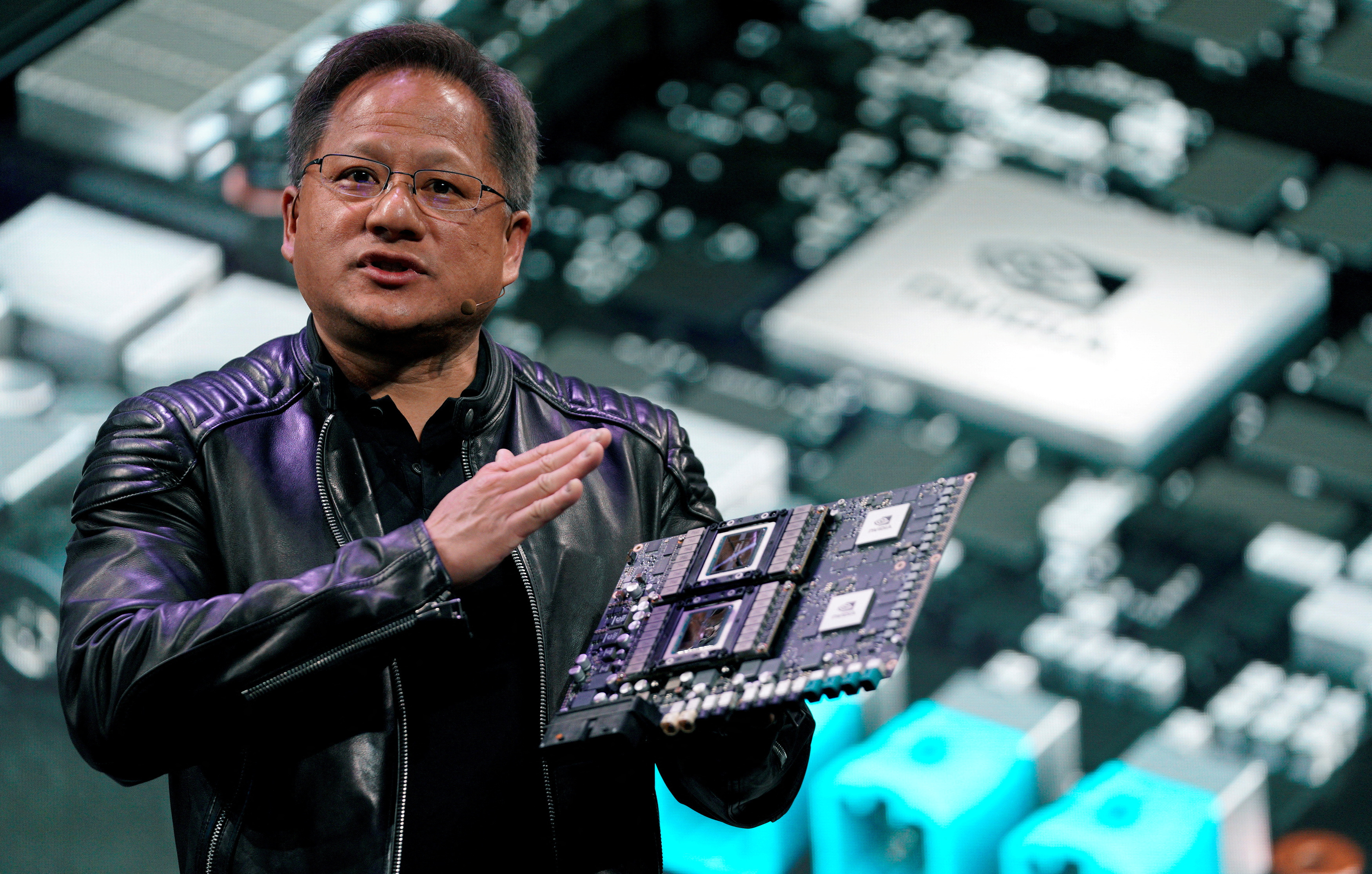

Nvidia continues to enjoy great progress

Nvidia is making waves in the AI GPU market with robust price upgrades and a strategic move into the Chinese market. The company's Q4 results and future outlook are generating significant attention from analysts and investors. Goldman Sachs recently raised its price target on Nvidia stock to an impressive $800, up from $625.

The firm's analysts maintain a "Conviction Buy" rating on Nvidia shares, highlighting their optimism about the company's future performance. The analysts point to several constructive data points that indicate increasing investment in artificial intelligence (AI) infrastructure. They also expect significant upside potential for Nvidia, exceeding expectations for 2024 and 2025. This bullish view is supported by a compelling risk-reward profile for Nvidia stock.

In addition, Goldman Sachs adjusted its earnings forecasts for fiscal years 2025 and 2026. These adjustments are based on recent industry data indicating robust demand for AI servers and improved availability of GPUs.

Bank of America (BofA) analyst Vivek Arya has also revised Nvidia's price target, raising it from $700 to $800. Arya maintains a "Buy" rating on Nvidia's stock as the company approaches its Q4 earnings report, scheduled for release after the close of trading on February 21. BofA's expectations for Nvidia's Q4 report are cautiously optimistic. The analyst expects a notable but measured increase of 3-5% in both reported Q4 and guided Q1 revenue. This expected growth can be attributed to gradual improvements in supply, offset by constraints related to China.

While 3-5% may seem less dramatic compared to Nvidia's previous quarters, which showed 10% and 22% beat-and-raise performances, Arya argues that this measured pace lays the groundwork for sustainable growth. Instead of focusing solely on immediate gains, this approach could create a fertile environment for Nvidia's ongoing expansion. Nvidia's China-specific AI graphics card In a strategic move, Nvidia has launched pre-orders for a China-specific AI graphics card known as the H20.

Distributors are pricing this graphics card competitively with a similar product offered by Huawei, signaling Nvidia's commitment to the Chinese market. This strategic pivot comes in response to the expanded US bans on high-end semiconductor exports. Nvidia has developed three graphics cards specifically for the Chinese market, with the H20 being the most potent among them. By offering an AI graphics card designed to meet China's unique needs and market conditions, Nvidia aims to consolidate its presence in the country.

China represents a significant market for AI, making it a strategic imperative for Nvidia to effectively navigate the regulatory landscape.

Latest graphics card

-

20 Margraphics card

-

13 Jangraphics card

ASRock B580 Steel Legend

-

07 Jangraphics card

ASUS showcases new AMD RX 9700 graphics cards

-

07 Jangraphics card

ASUS ready with large selection of RTX 50 graphics

-

07 Jangraphics card

Nvidia Reflex 2 reduces gaming latency

-

07 Jangraphics card

Nvidia launches DLSS 4 with the new RTX 50 series

-

07 Jangraphics card

Nvidia RTX 50 series is ready

-

07 Jangraphics card

Nvidia launches RTX 5090 at CES

Most read graphics card

Latest graphics card

-

20 Margraphics card

ASRock RX 9070 Steel Legend

-

13 Jangraphics card

ASRock B580 Steel Legend

-

07 Jangraphics card

ASUS showcases new AMD RX 9700 graphics cards

-

07 Jangraphics card

ASUS ready with large selection of RTX 50 graphics

-

07 Jangraphics card

Nvidia Reflex 2 reduces gaming latency

-

07 Jangraphics card

Nvidia launches DLSS 4 with the new RTX 50 series

-

07 Jangraphics card

Nvidia RTX 50 series is ready

-

07 Jangraphics card

Nvidia launches RTX 5090 at CES