Exclusively-Intel manufacturing store drawers

Intel's contract manufacturing business has suffered a setback after tests with chipmaker Broadcom failed, three sources with knowledge of the matter told Reuters. This is a blow to the company's attempts to turn the situation around.

The tests Broadcom conducted involved sending silicon wafers through Intel's most advanced manufacturing process known as 18A, the sources said. Broadcom received wafers back from Intel last month. After the company's engineers and managers reviewed the results, they concluded that the manufacturing process is not yet viable to move on to mass production.

Reuters could not determine the current relationship between Broadcom and Intel or whether Broadcom had decided to back out of a potential manufacturing deal.

"The Intel 18A is enabled, healthy and performing well, and we remain fully on track to begin mass production next year," an Intel spokesperson said in a statement. "There is a lot of interest in Intel 18A across the industry, but as part of our policy we do not comment on specific customer conversations."

A Broadcom spokesman said the company is "evaluating the product and service offerings of Intel Foundry and has not yet completed that evaluation."

Intel's contract manufacturing business was launched in 2021 as a key component of CEO Pat Gelsinger's strategy to turn the company around.

Broadcom isn't a name most people know, but the company makes key networking equipment and radio components that helped generate $28 billion in total chip sales last fiscal year. It has benefited from increased investment in artificial intelligence hardware, and JP Morgan analyst Harlan Sur estimated that the company will earn $11 billion to $12 billion from AI this year, up from $4 billion last year.

Some of the company's chip sales come from deals with companies like Alphabet's Google and Meta Platforms to help produce in-house AI processors, which could include deals with a manufacturer like Intel or Taiwan Semiconductor Manufacturing Co.

Important setback

As part of a disastrous second-quarter report that slashed the company's market value by more than a quarter, Intel announced a 15% workforce cut and a reduction in capital spending related to factory construction. Gelsinger and other executives will present a plan to the board in mid-September on possible cuts to business units and teams to reduce costs, Reuters reported on Sunday.

Intel has committed about $100 billion in expansion and construction of new factories at several locations in the United States. An important part of the company's expansion involves attracting large customers such as Nvidia or Apple to fill the capacity of all the new locations.

Intel reported an operating loss of $7 billion for the foundry business, wider than the $5.2 billion loss the year before. Executives expect the contract chip business to break even in 2027.

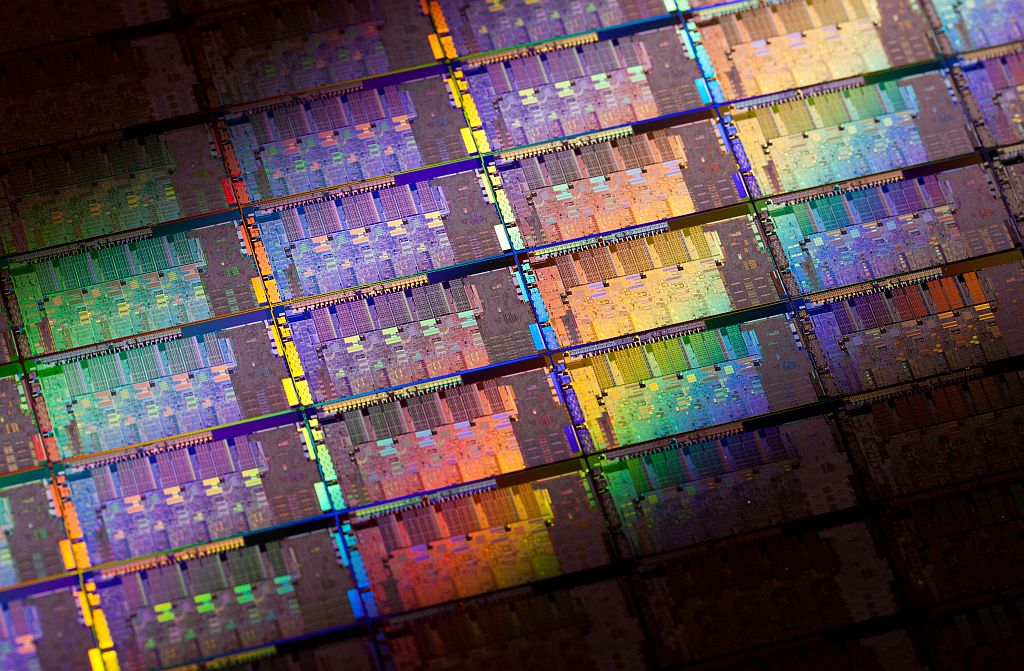

Typically, manufacturing an advanced chip requires more than 1,000 separate steps in a chip factory, or "fab," and takes about three months to complete. Production success is determined by the number of functioning chips on each silicon wafer. Achieving a significant yield is critical to being able to produce the tens or hundreds of thousands of wafers that major chip designers demand.

Broadcom engineers had concerns about the viability of the process, the sources said. Typically, this refers to the number of defects on each wafer or the quality of the chips produced.

For an advanced manufacturing process used by TSMC, the Taiwanese giant charges about $23,000 per wafer at high volume, according to two sources with knowledge of the pricing. Reuters could not determine Intel's wafer pricing.

TSMC declined to comment on its wafer pricing.

Moving a chip design from a manufacturing process used by a company like TSMC to another vendor like Samsung or Intel can take months and require dozens of engineers, depending on the complexity of the chip and the differences in manufacturing technology.

Committing to a new manufacturing process like Intel's 18A is impossible for some smaller chip companies because it would require resources they don't have.

Intel released its manufacturing tool for the 18A process to other chipmakers over the summer, Gelsinger said during an earnings call last month.

The company plans to be "production ready" by the end of the year for its own chips and begin mass production for outside customers in 2025, Gelsinger said. At an investor conference last week, he said there are a dozen customers "actively engaged" with the toolkit.

Latest processor - cpu

-

31 Octprocessor - cpu

-

16 Sepprocessor - cpu

AMD Ryzen AI 7 PRO 360 spotted

-

04 Sepprocessor - cpu

Intel scores big AI chip customer

-

04 Sepprocessor - cpu

Exclusively-Intel manufacturing store drawers

-

29 Augprocessor - cpu

Big performance boost for Ryzen CPUs

-

28 Augprocessor - cpu

Intel shares could fall in battle with TSMC and NV

-

28 Augprocessor - cpu

AMD is claimed to have been hacked

-

27 Augprocessor - cpu

Intel presents Lunar Lake, Xeon 6, Guadi 3 chips

Most read processor - cpu

Latest processor - cpu

-

31 Octprocessor - cpu

AMD will launch the Ryzen 7 9800X3D on November 7

-

16 Sepprocessor - cpu

AMD Ryzen AI 7 PRO 360 spotted

-

04 Sepprocessor - cpu

Intel scores big AI chip customer

-

04 Sepprocessor - cpu

Exclusively-Intel manufacturing store drawers

-

29 Augprocessor - cpu

Big performance boost for Ryzen CPUs

-

28 Augprocessor - cpu

Intel shares could fall in battle with TSMC and NV

-

28 Augprocessor - cpu

AMD is claimed to have been hacked

-

27 Augprocessor - cpu

Intel presents Lunar Lake, Xeon 6, Guadi 3 chips