Intel still in trouble

Intel forecast lower-than-expected revenue and profit in its second-quarter results, sending shares down 8%. This is due to weak demand for its traditional data center and PC chips, as well as the company falling behind in the growing market for AI components.

Companies are increasingly prioritizing investments in advanced and fast artificial intelligence server chips, hurting demand for Intel's CPUs, which have powered data centers for decades. Nvidia, which dominates the market for AI chips with its powerful GPUs, had about 80% market share last year. Intel's other major market, PC chips, has had a difficult period over the past two years, but is now starting to show signs of life.

While Intel lost $11 billion in market value after announcing the result, Nvidia's value grew by $40 billion. This is due to strong results from Microsoft and Alphabet as the two cloud giants race to expand their AI product lines. In addition to using Nvidia's AI chips, Microsoft and Alphabet's Google also design chips in-house for their data centers.

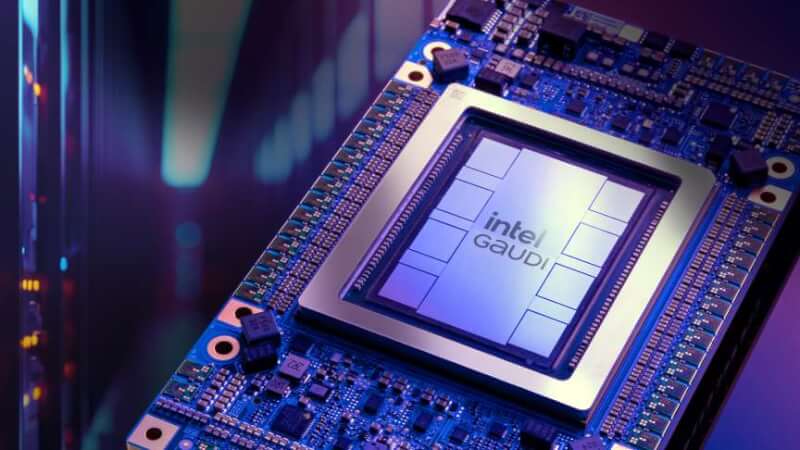

Intel's Gaudi AI chips are expected to generate more than $500 million in revenue this year, according to CEO Pat Gelsinger. Intel launched its third-generation Gaudi 3 processor in April to improve competition with Nvidia. Although Intel has had a difficult start to the year and a weak forecast for the second quarter, Gelsinger is optimistic and believes that almost all of Intel's products will rebound in the second half of 2024.

Nvidia has dominated the AI market with their GPUs, but increasing demand and Nvidia's limited supply of these advanced chips have created opportunities for both Intel and AMD to take market share.

Intel is optimistic about PC sales in the second half of the year as it expects a new PC upgrade cycle associated with a new version of Microsoft's Windows operating system. In short, Intel faces challenges in both the data center and PC markets, but still sees great opportunities in the growing AI market.

Latest processor - cpu

-

31 Octprocessor - cpu

-

16 Sepprocessor - cpu

AMD Ryzen AI 7 PRO 360 spotted

-

04 Sepprocessor - cpu

Intel scores big AI chip customer

-

04 Sepprocessor - cpu

Exclusively-Intel manufacturing store drawers

-

29 Augprocessor - cpu

Big performance boost for Ryzen CPUs

-

28 Augprocessor - cpu

Intel shares could fall in battle with TSMC and NV

-

28 Augprocessor - cpu

AMD is claimed to have been hacked

-

27 Augprocessor - cpu

Intel presents Lunar Lake, Xeon 6, Guadi 3 chips

Most read processor - cpu

Latest processor - cpu

-

31 Octprocessor - cpu

AMD will launch the Ryzen 7 9800X3D on November 7

-

16 Sepprocessor - cpu

AMD Ryzen AI 7 PRO 360 spotted

-

04 Sepprocessor - cpu

Intel scores big AI chip customer

-

04 Sepprocessor - cpu

Exclusively-Intel manufacturing store drawers

-

29 Augprocessor - cpu

Big performance boost for Ryzen CPUs

-

28 Augprocessor - cpu

Intel shares could fall in battle with TSMC and NV

-

28 Augprocessor - cpu

AMD is claimed to have been hacked

-

27 Augprocessor - cpu

Intel presents Lunar Lake, Xeon 6, Guadi 3 chips