Samsung's profits rise massively

Samsung Electronics estimated on Friday that its operating income for the first quarter will rise more than 10 times, exceeding market expectations. This is because chip prices have started to rise after a severe slump, thanks to a boom in artificial intelligence. But the information was not enough to cheer investors, who sent Samsung shares down 1.3% early Friday, in line with a 1.1% drop in the broader South Korean market, as they await updates on progress in their high -end memory chip business, which has lagged behind competitors.

The world's largest memory chip and TV maker estimated that operating income rose to a better-than-expected 6.6 trillion won ($4.89 billion) in the quarter ended March 31, beating a 5.7 billion won LSEG SmartEstimate. That was a 931% increase from 640 billion won a year earlier and will be Samsung's highest operating income since the third quarter of 2022.

But revenue missed expectations, probably rising 11% from the same period last year to 71 billion won, below an LSEG SmartEstimate of 72.3 billion won. 'Since revenue was relatively in line, but operating income exceeded expectations, the valuation of NAND flash chips may have improved. Demand for NAND has improved, which may have improved margins,' said Park Sung-soon, an analyst at the Korea Investor Relations Service.

'The initial response to the new Galaxy S24 smartphones was also positive due to on-device AI, so if a larger than expected proportion of the high-margin smartphones were sold, that will have an impact.' The company is expected to publish detailed earnings data on April 30.

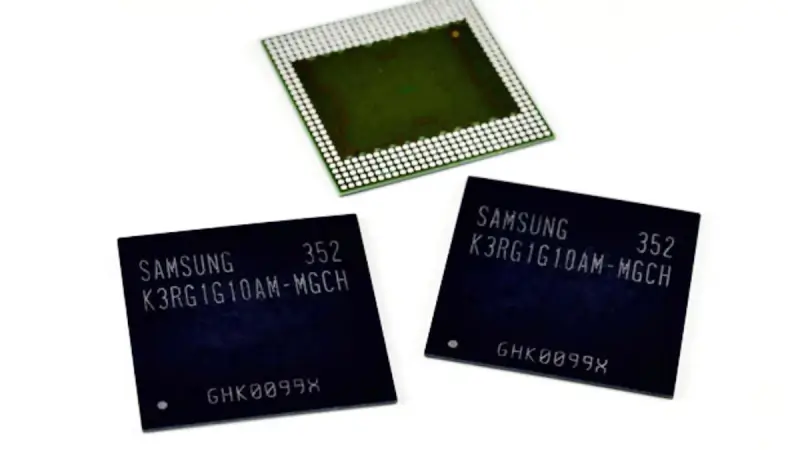

Increase in the chip price

The better performance comes as its chip division, traditionally its biggest earner, is expected to report its first quarterly profit in five quarters as memory chip prices recover from a deep slump that began in mid-2022 due to weak post- pandemic demand for gadgets. DRAM chip prices rose approximately 20% in the first quarter compared to the previous quarter, while NAND flash chip prices rose 23% to 28%, according to data provider TrendForce.

The positive outlook for memory chip demand, including explosive demand for chips such as high-bandwidth memory (HBM) used in AI chipsets, has driven a 34% rise in Samsung shares in the past 12 months, outpacing a 10% rise in the wider market. But it has underperformed its cross-company rival SK Hynix, whose shares rose 122% over the same period, in the booming HBM market, partly due to its relatively late entry into the segment.

Analysts expect Samsung to gradually catch up as it plans to begin shipments of its latest and most powerful HBM chips in the third quarter. The 7.2-magnitude earthquake that struck Taiwan on Wednesday is expected to tighten semiconductor supply, and analysts said Samsung and SK Hynix may raise memory chip prices by a sharper margin than previously planned, potentially boosting second-quarter earnings.

In its mobile business, Samsung is expected to report a solid profit following the launch of sales of its new flagship Galaxy S24 smartphones in late January, analysts said. Eugene Investment & Securities estimates Samsung shipped 57 million smartphones during the quarter, up 8% from the fourth quarter.

The average selling price of Samsung smartphones likely rose 30% to $340 quarterly, supporting profits. Global sales of Galaxy S24 smartphones rose 8% year-on-year in their first three weeks on the market, data provider Counterpoint said.

Latest processor - cpu

-

31 Octprocessor - cpu

-

16 Sepprocessor - cpu

AMD Ryzen AI 7 PRO 360 spotted

-

04 Sepprocessor - cpu

Intel scores big AI chip customer

-

04 Sepprocessor - cpu

Exclusively-Intel manufacturing store drawers

-

29 Augprocessor - cpu

Big performance boost for Ryzen CPUs

-

28 Augprocessor - cpu

Intel shares could fall in battle with TSMC and NV

-

28 Augprocessor - cpu

AMD is claimed to have been hacked

-

27 Augprocessor - cpu

Intel presents Lunar Lake, Xeon 6, Guadi 3 chips

Most read processor - cpu

Latest processor - cpu

-

31 Octprocessor - cpu

AMD will launch the Ryzen 7 9800X3D on November 7

-

16 Sepprocessor - cpu

AMD Ryzen AI 7 PRO 360 spotted

-

04 Sepprocessor - cpu

Intel scores big AI chip customer

-

04 Sepprocessor - cpu

Exclusively-Intel manufacturing store drawers

-

29 Augprocessor - cpu

Big performance boost for Ryzen CPUs

-

28 Augprocessor - cpu

Intel shares could fall in battle with TSMC and NV

-

28 Augprocessor - cpu

AMD is claimed to have been hacked

-

27 Augprocessor - cpu

Intel presents Lunar Lake, Xeon 6, Guadi 3 chips