Weak AMD forecast overshadows AI expectations

Advanced Micro Devices (AMD), one of the leading chipmakers in the world, presented a disappointing earnings forecast, although the company predicted that the new artificial intelligence (AI) processors would generate more revenue than expected this year. AMD expects revenue for the first quarter to be around US$5.4 billion, significantly lower than the US$5.77 billion expected by analysts. This is consistent with rival Intel's pessimistic view of the PC and data center chip markets.

After the announcement, AMD shares fell more than 6 percent in extended trading. That prospect has renewed concerns that customers are holding back from buying in AMD's core areas: PCs, servers, game consoles and programmable processors. Although the company is betting on AI accelerators - a lucrative area where Nvidia dominates - it is still early in this expansion.

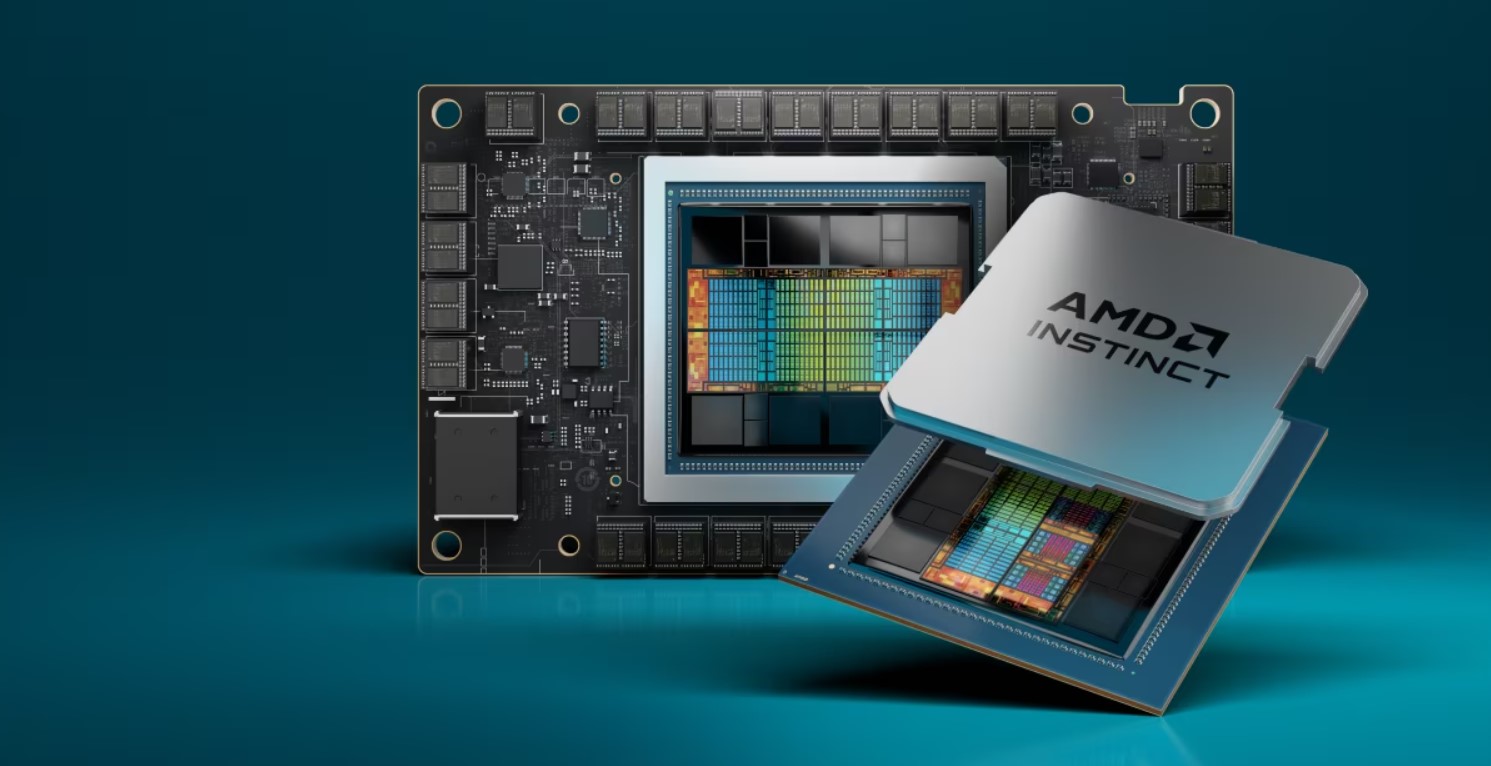

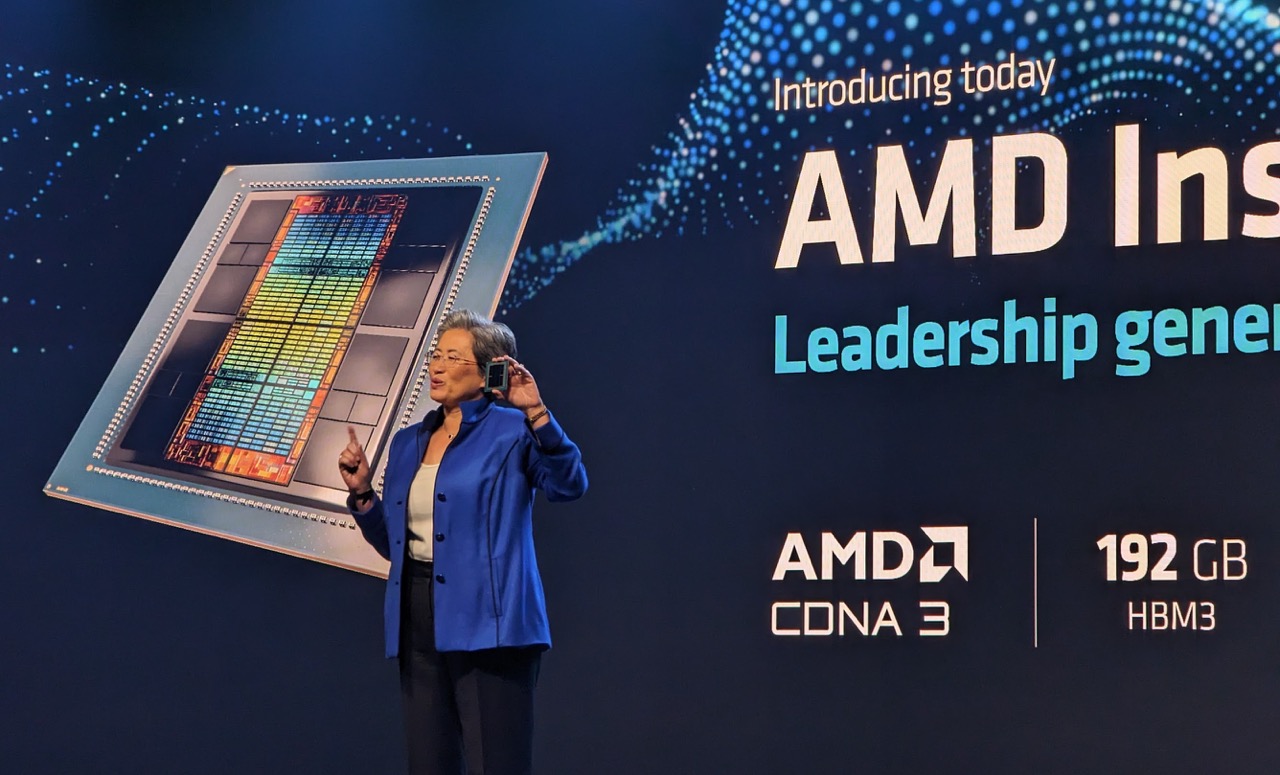

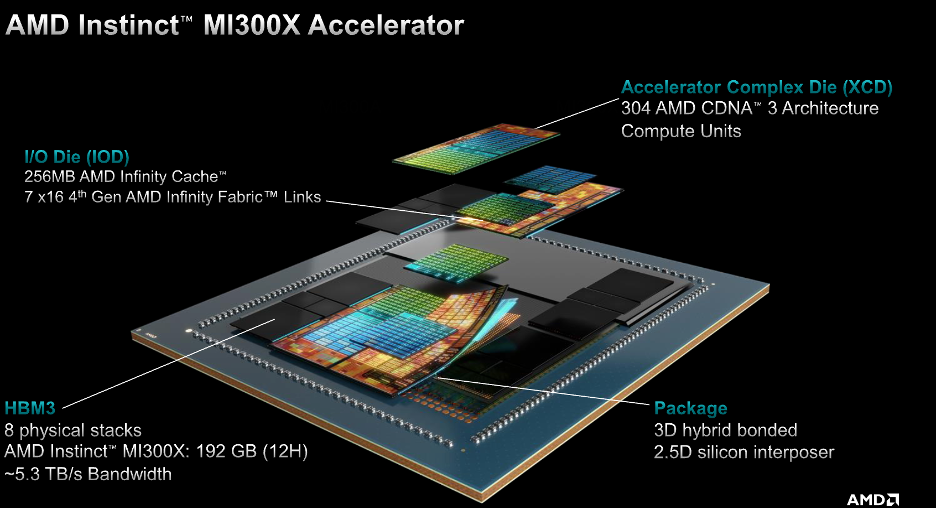

Last month, AMD unveiled a series of AI accelerators called the MI300. These chips help companies develop AI models by bombarding them with data, and they are in high demand. AMD predicted sales of more than US$3.5 billion for the MI300 in 2024, up from a previous prediction of US$2 billion.

But Wall Street has predicted numbers as high as $8 billion, according to Chris Caso, an analyst at Wolfe Research. AMD's stock has been one of the most popular among investors looking for ways to bet on AI computing. Its shares have been the second-best performing stock on the Philadelphia Stock Exchange Semiconductor Index this year, following a similar performance in 2023.

The big question is whether AMD's MI300 processors can challenge the dominance of Nvidia and their H100. That company's revenue doubled in the most recent fiscal year, according to estimates. However, Intel has seen weak demand in the programmable processor market, an area where it also competes with AMD.

These chips may have their function changed or updated even after they are installed in electronic devices. In its quarterly report last week, Intel said the lucrative market for data center processors is also weakening. Three months ago, AMD warned investors that demand for game console and embedded processors was slowing.

AMD is the second largest manufacturer of chips that go to graphics cards for the PC gaming market. AMD supplies chips to both Sony and Microsoft for their consoles. Nvidia leads the market for PC add-in card chips. AMD is also Intel's biggest rival in computer processors, the main component in laptops, desktops and server machines.

Latest processor - cpu

-

31 Octprocessor - cpu

-

16 Sepprocessor - cpu

AMD Ryzen AI 7 PRO 360 spotted

-

04 Sepprocessor - cpu

Intel scores big AI chip customer

-

04 Sepprocessor - cpu

Exclusively-Intel manufacturing store drawers

-

29 Augprocessor - cpu

Big performance boost for Ryzen CPUs

-

28 Augprocessor - cpu

Intel shares could fall in battle with TSMC and NV

-

28 Augprocessor - cpu

AMD is claimed to have been hacked

-

27 Augprocessor - cpu

Intel presents Lunar Lake, Xeon 6, Guadi 3 chips

Most read processor - cpu

Latest processor - cpu

-

31 Octprocessor - cpu

AMD will launch the Ryzen 7 9800X3D on November 7

-

16 Sepprocessor - cpu

AMD Ryzen AI 7 PRO 360 spotted

-

04 Sepprocessor - cpu

Intel scores big AI chip customer

-

04 Sepprocessor - cpu

Exclusively-Intel manufacturing store drawers

-

29 Augprocessor - cpu

Big performance boost for Ryzen CPUs

-

28 Augprocessor - cpu

Intel shares could fall in battle with TSMC and NV

-

28 Augprocessor - cpu

AMD is claimed to have been hacked

-

27 Augprocessor - cpu

Intel presents Lunar Lake, Xeon 6, Guadi 3 chips